Mobile icebergs in the sea of payments

11 Oct 2024tl:dr

- Implicit: Payments and Processing are mostly hidden.

- Explicit: Mobile banking has changed everything for customers and consumption.

- Tacit: Mobile banking != payments but there have been changes

- Is the sea of payments about speed or convenience?

Intro and Warning:

Been grinding on a work project which might reappear elsewhere here once the scars have healed sufficiently. Have the usual backlog of unfinished observations, explorations and ruminations for interesting adjacent areas but wanted to get this out as first off the pile.

This is the culmination of a few conversations, presentations and notes which overlapped.

In no particular order:

-

Friends/Family: “I just tap or use Apple/Google/Samsung Pay for everything now - Payments is so simple”

-

Colleague: “I run my business out my phone/tablet - never been into a branch”

-

Colleague: “Hey, you do Product in Banking and Payments - could you give a quick overview to my team about payments, mobile banking and all that…”

(For full disclosure, I have been involved with Payments in various forms for over 12 years at National Payment Providers, banks, startups and card rail networks. I have experience both in the Business to Consumer (B2C) and Business to Business (B2B) arenas.)

So how did that turn out?

1. Implicit: Hidden depths

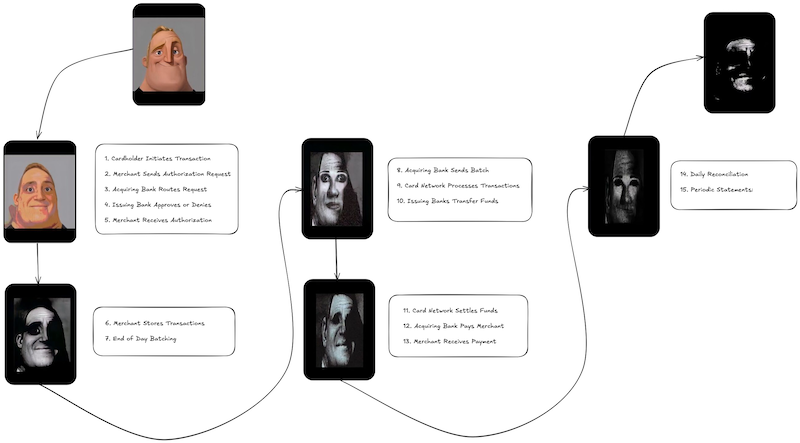

Now the warning… When you start explaining ‘Payments’ in terms of the processing behind even a ‘simple’ credit or debit card transaction to most people, the last vision many report before the coma hit was of an iceberg. The 10% seen is the swiping/tapping a card/phone or entering card details, then some bank stuff, then the approval (usually a couple of seconds) and I can have the thing. 90% is dark and murky and really only matters if you crash into it.

(If you want to try this fun game in a safe and well padded space you can walk through the below diagram - explaining each of the actors and steps if you want full tonic immobility).

“Click to view full size image”)

“Click to view full size image”)

Now for the good news - mobile banking has revolutionised payments and this is what an AI image generator thinks that looks like:

and no, I don’t really understand what’s going on - its the latest technology and that’s got to be better, right?

But, yes, mobile payments (cashless/cardless) have changed everything - speed, convenience, service integration and customer expectations/behaviour.

2. Explicit: All change

Nothing about the following has remained the same for anyone who has ever seen a cheque-book, mag-stripe card or feature phone (well maybe not the last one…)

- Processes - retail shopping, ticketing/public transportation, Ordering/food & beverages

- Peer to Peer payments - sending/ sharing money (including overseas)

- Small and Micro Businesses with their own Point of Sale on a phone/tablet

- Notifications, controls, instant access to balances and of course doing it all remotely/online.

The transition to mobile as the primary platform for retail customers (B2C) happened several years ago, making mobile banking a fundamental aspect of retail banking services. It’s reasonable to say that business banking customers (B2C) now also expect at least a basic level of mobile functionality.

The key driver of this shift has been the influence of digital-only challenger banks like Monzo and Revolut, which introduced business banking products that pushed traditional high-street banks to adapt and improve their own offerings. As mobile functionality continues to improve, this naturally fosters greater mobile adoption, reshaping users’ expectations for managing business finances.

For example, recently Tide acquired Onfolk with the aim of integrating their complete accounting, payroll, and pension system into Tide’s business banking app.

Obviously, the size and turnover of the enterprise is the main driver - from a project I worked on, roughly 50% of <£50,000 turnover businesses made use of the mobile banking channel (not all functions), dropping to 30% for larger companies. However, the majority of total transactions are still done via desktop - the desktop portal is not going away any time soon. But, mobile apps are being used for other functionalities. This would include activities such as viewing statements, amending business details, and uploading receipts for expenses.

Functions such as managing sales, managing cards, creating virtual cards, setting limits etc. are all things which are also now expected across the board. The goal is of course, channel parity - meaning that all services are available based on customer preference to suit businesses irrespective of size.

The changes will keep coming.

Obviously this is all from a customer perspective, but bearing in mind the iceberg above, what has actually changed, as it were - below the water?

3. Tacit: Mobile Banking

Sure the iceberg is quite a lot faster than it used to be, it has some new pieces - largely to do with security (think biometrics, PIN Numbers etc.) real-time fraud detection built in plus some new faces (think QR codes, Digital wallets, switching between apps etc.) but the steps/flow needed before altering some digital balances held on the relevant systems, remains largely unchanged.

So here’s the point. The world of mobile ‘banking’ around a payment now offers a comprehensive, secure and flexible management tool but that isn’t the same as the payment which needs to go through.

There is a sea of payments anyway - card to card, card to account, account to account, crypto and even deferred payment but the fundamental model remains despite what the consumer sees. Viewed this way a payment is a flow of moving value (money or it’s digital equivalent) from one store to another and with a little variation, the steps and actors involved will remain unchanged in the universality of the concept.

4. Speed or Convenience?

This leads to a final thought and loops back to what has actually been achieved and perhaps the incentives behind it. At this stage I’m veering dangerously toward monetary theory and power relations (which certainly needs more discussion). Financial inclusion and protection are unquestionably net positive. Yes, giving more control and information to the customer is a fundamental good, more ways to pay and receive essentially also, but what is actually going on as we shift to the methods which allow this? Certainly the underlying model/s and actors probably won’t change much but then neither will most people’s understanding of what could, and does, lay beneath — just like with icebergs.

If you wish, with the above veering, to go down the rabbit hole (which path even I can’t follow completely and plunges into caverns that feel like Marxian economics) I would recommend Brett Scott for: “Paymentspotting - Nine steps towards seeing money in 3D” or even “Tech doesn’t make our lives easier. It makes them faster.”. It’s quite a different view but then (bonus xkcd reference) maybe we should think twice about attaching hydrogen filled scout airships as iceberg spotters to our unsinkable ocean liners?